Private Philanthropy and Hurricane Katrina

As the 10-year anniversary of Hurricane Katrina approaches, there’s been an uptick news stories that both remember the storm’s damage and assess where recovery stands now. One of the reasons that the Center for Disaster Philanthropy finds Katrina so important is that it was a catastrophic event that relied heavily on private philanthropy to boost […]

As the 10-year anniversary of Hurricane Katrina approaches, there’s been an uptick news stories that both remember the storm’s damage and assess where recovery stands now.

One of the reasons that the Center for Disaster Philanthropy finds Katrina so important is that it was a catastrophic event that relied heavily on private philanthropy to boost recovery. It was clear after the storm passed that disasters required the coordinated, meaningful action of private donors and that those funders had the ability to shape recovery in ways public relief and recovery dollars never could.

So instead of reviewing the many statistics on the damage of America’s costliest storm, I thought it might be interesting to look at private philanthropy following Hurricane Katrina as told through five charts from the Foundation Center:

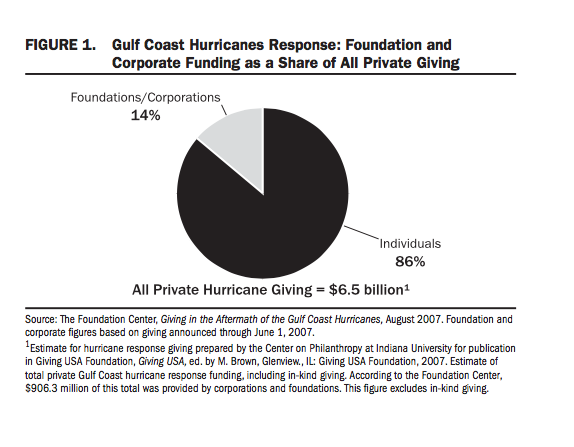

- Americans as individuals responded incredibly generously following the storm. In fact, 86 percent of private giving came from individuals.

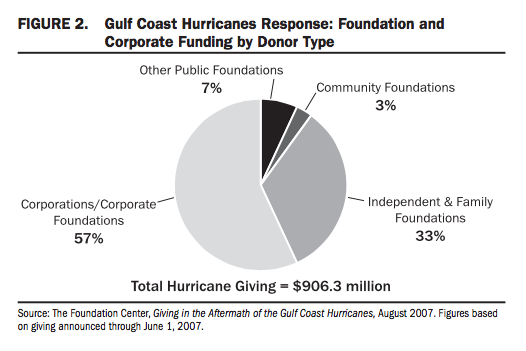

- Corporations provided more than half of the private organizational funding for Hurricane Katrina relief and recovery.

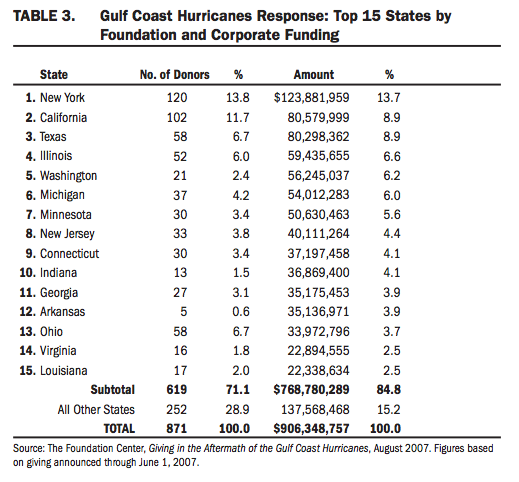

- The largest share of private funding by state came from New York, although response came from organizations all across the U.S.

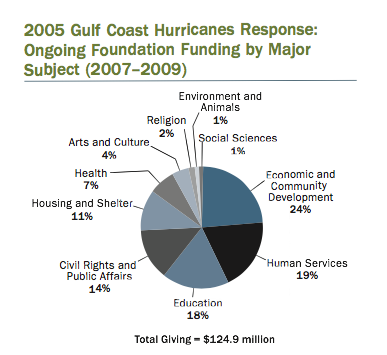

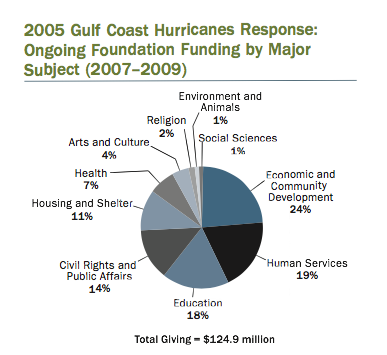

- Much of the initial funding following the storm went to immediate relief in a variety of areas. However, private funders recognized the changing and continued needs of recovery in a number of ways, expressed through ongoing grants two to four years and even further after Katrina occurred.

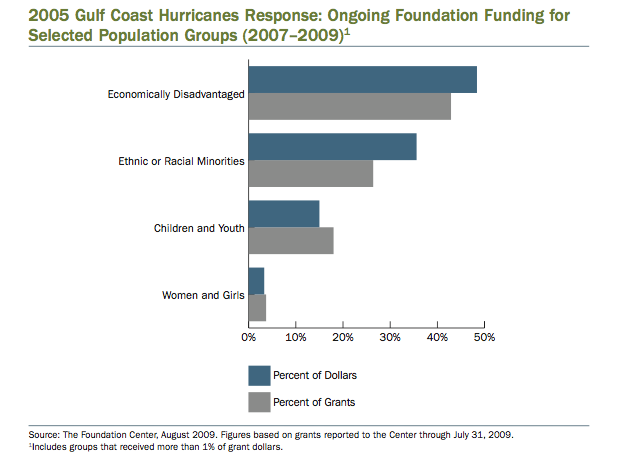

- Private donors also recognized the need to prioritize vulnerable populations, funding initiatives to assist children, women, and economically disadvantaged groups well past four years following the storm.

Read the full reports from the Foundation Center from 2007 and 2009, and see more on CDP’s Hurricane Katrina profile.

More like this

How Black History Has Influenced Disaster Planning